We invest so a lot of energy exploring the most recent model, the jazziest hues, and the snazziest of wellbeing highlights and we love it! However, a large portion of us knows too minimal about car insurance and all that it involves. Here we have arranged for you a far-reaching manual for car insurance-it’s all that you’ve at any point needed to know, and that’s just the beginning.

The idea of Motor Insurance

Car insurance deals with “utilize it or lose it” strategy. To benefit it, you need to pay a yearly premium. On the off chance that you are lucky enough to not have a genuine enough mishap to need to guarantee, you lose the top-notch sum you paid for protection. On the other hand, you get a No Claim Bonus, which is a truly generous sum beginning from 20% of the premium in the first year to half in the 6th which is the reason it’s generally advised not to claim for minor harms.Find cheap car insurance on moneyexpert.com.

Here we’ve arranged for you a far-reaching manual for car insurance-it’s all that you’ve at any point needed to know.

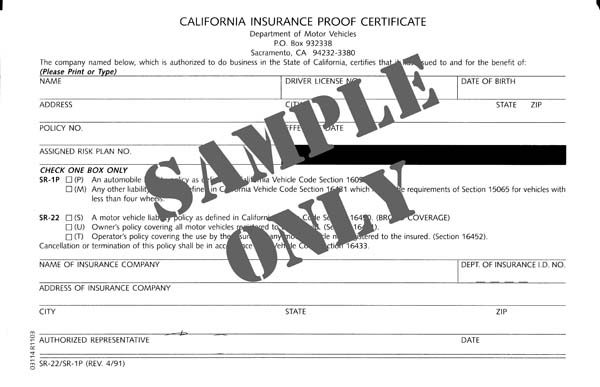

What’s SR22 car insurance?

SR-22 car insurance is a certificate of insurance that demonstrates you carry car insurance. A few people refer to it as SR 22 car insurance, or a certificate of financial responsibility (CFR) documenting. The SR22 states you’re meeting your state’s car insurance coverage necessities for driving over a specified measure of time.

Register yourself for sr22 car insurance and get free quotes.

Who needs SR-22 car insurance?

You may require SR22 coverage if you have one of the following driving violations (your state may likewise require them for reasons not recorded underneath):

- DUI or DWI

- Careless driving

- At-fault accidents

- Driving without insurance coverage

- Driving with a suspended permit

You may likewise require an SR-22 on the off chance that you have a lot of little occurrences heap up after some time. Once more, it’s diverse for each state. Great drivers who don’t have any criminal offences don’t need to get an SR22 to be lawful on the road.

-

Is SR-22 considered car insurance?

SR 22 means you’re meeting your state’s car insurance least necessities for driving and isn’t viewed as car insurance itself.

-

Do I have to do to get SR-22 insurance?

Extra information varies by state, however, all in all, just demonstrating you’re a driver needing an SR 22 filing when acquiring your auto insurance policy is sufficient. Your insurance carrier can take it from that point. You’ll have to give your driver’s permit number or other distinguishing proof numbers for them to record with your state.

-

What Kinds of SR 22 certificates are there?

There are three sorts of SR22 insurance:

- Operator: An Operator’s Certificate is intended for drivers who obtain or lease a car, however, don’t claim a car. This is here and there utilized with a non-proprietor car insurance strategy

- Owner: An Owner’s Form is for the individuals who possess and drive their car.

- Operator/Owner: An Operator/Owner Form is a mix structure that applies to the individuals who possess their car, yet also get or lease one to drive periodically.

- Know more about sr22 insurance at different websites.

- Apple iPhone 17: A Powerful and Feature-Rich Smartphone - September 22, 2025

- Everything You Should Know About Car Insurance - October 30, 2019

- Track phone activities of your boyfriend through spy apps - October 8, 2019

- Find your home protection at affordable rates - September 25, 2019

- 4 Essential Tips for Getting Cheap Car Insurance - September 19, 2019

- Life Insurance policies – Most important investment of your life! - September 18, 2019

- Top 7 Differences Between NodeJS and AngularJS - August 30, 2019

- Amazing New Angular 8.0 the Top 6 Features Here - August 30, 2019

- Understand All about Medicare Insurance and Its Benefits - August 29, 2019

- Why Health insurance is Considered a Priority? - August 27, 2019