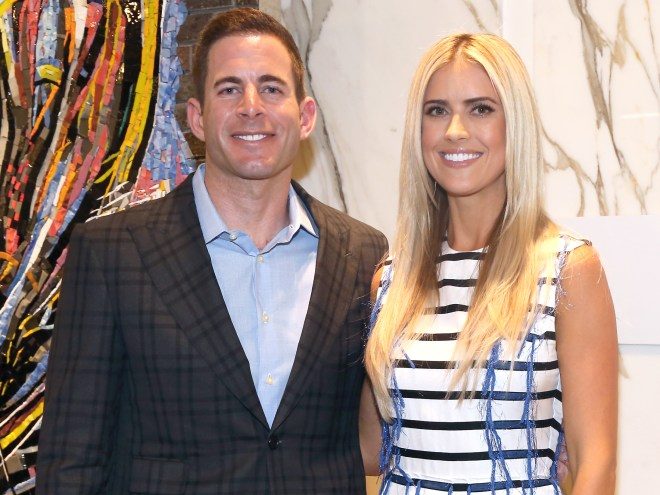

The future of one of the most popular reality shows on the cable television schedule hangs in the balance as Flip or Flop stars Christina and Tarek El Moussa face the possible cancellation of their series.

Home and Garden Television executives are reportedly very unhappy that the series hosts are divorcing, as a married couple serving as co-hosts helped Flip or Flop stand out from the crowd, and they do not believe the show will have the same edge if the hosts aren’t married or at least aren’t acting like a family in public. One source insists that the network issued an ultimatum to the couple: patch up your differences or we will cancel the show and sue you for breach of contract.

One insider opined that the couple married basically to draw viewers to their show. “They weren’t only working on a reality show — they were putting on a show,” one neighbor remarked.

Value

Most closely-held businesses are the couple’s sole source of income, and these enterprises usually have a very high emotional value as well. As a result, and also because a business has different purposes for different owners and potential buyers, business valuation is a very subjective exercise. There are three recognized methods:

- Asset: This approach basically looks at the cost to replace ABC Company with a similar firm based simply on assets and liabilities. While it’s usually the most straightforward approach and well-suited for many businesses, it does not take intellectual property and other “intangible values” into account, and many businesses are worth more than the sum of their parts.

- Market: Similar to residential real estate, the business appraiser looks at comparable business sales in the area to determine ABC Company’s value. One of the principal drawbacks with this popular method is that these valuations generally have a rather short shelf life, because the market value five or six months down the road could be significantly different from today’s market value.

- Income: This model is the most subjective approach in a subjective exercise, because it estimates the potential income of ABC Company if new owners made a similar commitment to the business as the old ones.

We asked HosseinBerenji, a divorce attorney at Berenji& Associates in Los Angeles, CA, to explain the difference in these approaches. He summed it by nicely by stating, “to a certain extent, all these models are market approaches, because in short, a business is worth whatever people are willing to pay for it.”

Disposition

Once everyone has agreed on a value, it’s probably a good time to think about what will happen to the business after the divorce. Many couples can get along fairly well as business partners, or they are at least willing to bury the hatchet during business hours if it means they do not have to sell the family business.

If working together is not an option, and it normally is not, one spouse may want to keep the business alive while the other one follows a different career path. If a buyout is not feasible, the parties can normally negotiate an offset, e.g. Husband keeps the business and forfeits any interest in Wife’s retirement account.

The straight-up sale and division is usually the best idea, because even though it means the end of a family business, it is the cleanest and easiest alternative.

Classify

That being said, the business must be classified as either community or separate property before the parties can discuss the nuts and bolts of division, because this issue often has a substantial bearing on offsets and other matters.

Businesses are nearly always commingled, at least to some extent. For example, Wife might work a side job in addition to her responsibilities at the family business, and pour nearly all her income into the closely-held corporation. Legally, all marital property in California is presumed to be community property that’s subject to equal division, unless the challenging party can prove, by clear and convincing evidence, that the property is separate.

To acquire such evidence, attorneys often work with forensic accountants who can go back years or even decades to trace certain property and present compelling evidence to the judge.

- Key Factors to Consider When Selecting Oligonucleotides for Your Research - January 25, 2025

- Refrigerator Buyer Beware: Common Pitfalls to Avoid - January 15, 2025

- How E-Libraries Help People Rediscover Their Love for Reading - October 30, 2024

- Advancements in data analytics that assist research nurses - October 29, 2023

- If Thinking Of Setting Up a Financial Portfolio – Include Property Investment. - July 13, 2023

- Why healthcare could be the perfect career change for you - May 11, 2023

- Pressure Washing Tips: Keep Your Home Looking Clean and Beautiful - March 20, 2023

- All about savings account interest rates - February 11, 2023

- What Fashion Trends Are Returning? A Guide to Reviving Fashions - December 20, 2022

- 5 Keys to Protect Your Mobile Phone from Undercover Journalists - June 29, 2021