You will be shocked to know that most of the auto insurance company which is present in the USA is a comprehensive one. As per a survey, it was found that almost eighty percent of the auto insurance, which is sold in the UK, was the comprehensive one. The main motive of buying insurance from the auto insurance company is that in case of an accident, they will cover you from the critical financial position. But the level of cover which you get from the insurance company depends completely on you. We will discuss now, the types of auto insurance which exists.

- Liability Insurance – This Insurance in the USA is also referred to as the third party insurance and is the lowest form of insurance which is offered by the auto insurance company. This is basic insurance which you can take for your vehicle, and in case of an accident if it is found that you were at fault, then the insurance company is liable to pay the damage to the other party. You will be shocked to know that the insurance limit is set by the company at the beginning of the policy. Here, the insurance limit is the maximum amount which an insurance company will pay in case of an accident.

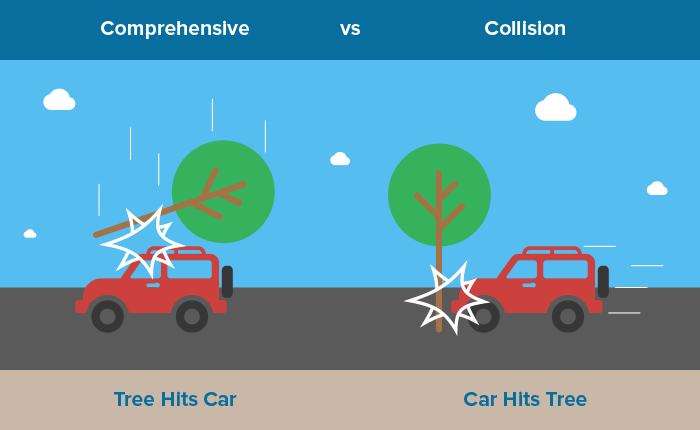

- Comprehensive Insurance – As the name suggests, this insurance company will offer you insurance, which will be comprehensively covered. In other words, it can be said that if you are responsible for the accident, then the cost of repair of the vehicle will be paid under the insurance. Usually, it has been found that comprehensive insurance has comparatively higher limit compared to the third party insurance. But the main problem comes when an insurance company works in collaboration with the market valuation of your car. Because it is quite normal that the market value of your car is much less than it is expected.

There is some other insurance also which falls under the auto insurance of the USA but gives a wider cover of insurance compared to the one mentioned above. Like a type of insurance which is known as Personal Injury Protection or no fault cover. In this form of insurance, if you meet with a collision, then the insurance company is responsible for covering the medical expenses of you along with the passenger medical expenses. If your policy has no fault cover, then the benefit that you will get is, irrespective of the person at fault you will cover by it. Having this facility in your insurance will give you peace of mind that at least the insurer will be covered.

You need to seek for a particular type of insurance which is required by you and is mandatory under your state. The requirement of auto insurance depends upon the state to state, and it might be different for the USA. Hence, it is always advisable to approach an insurance company and enquire details for the same. Apart from the type of insurance, there are some other things too which you should consider before taking the services offered by the auto insurance company in the USA. You must ask the insurance company for the general insurance quote so that you can figure out the one which will be beneficial for you. Apart from this, you can also compare the price which is charged by different Insurance Company along with their service. If you go across all this point, then I can assure you that at the end you will find a genuine insurance company in the USA.

- Pest-Prevention Tips For Townhouses In Bangkok - August 3, 2022

- Do You Feel Like Your Advertising Doesn’t Work Anymore? It’s Time to Rethink - January 19, 2021

- A Definitive Guide to the Differences Between Intel Processor Generations - December 21, 2020

- How to make a better first impression - December 15, 2020

- How to Use Collagen vs. Gelatin - August 23, 2020

- What Should I Do After a Car Accident in Los Angeles? - August 14, 2020

- What Are My Rights as A Passenger After a Lyft Accident? - August 8, 2020

- How to Set Up a Child to Study From Home and Not to Go Crazy: 15 Psychological Tips - August 6, 2020

- 5 Things Related to Buying a Property You Probably Didn’t Know - July 27, 2020

- Alexander Smith is author of Techzelo.com (music technology review site) - July 13, 2020